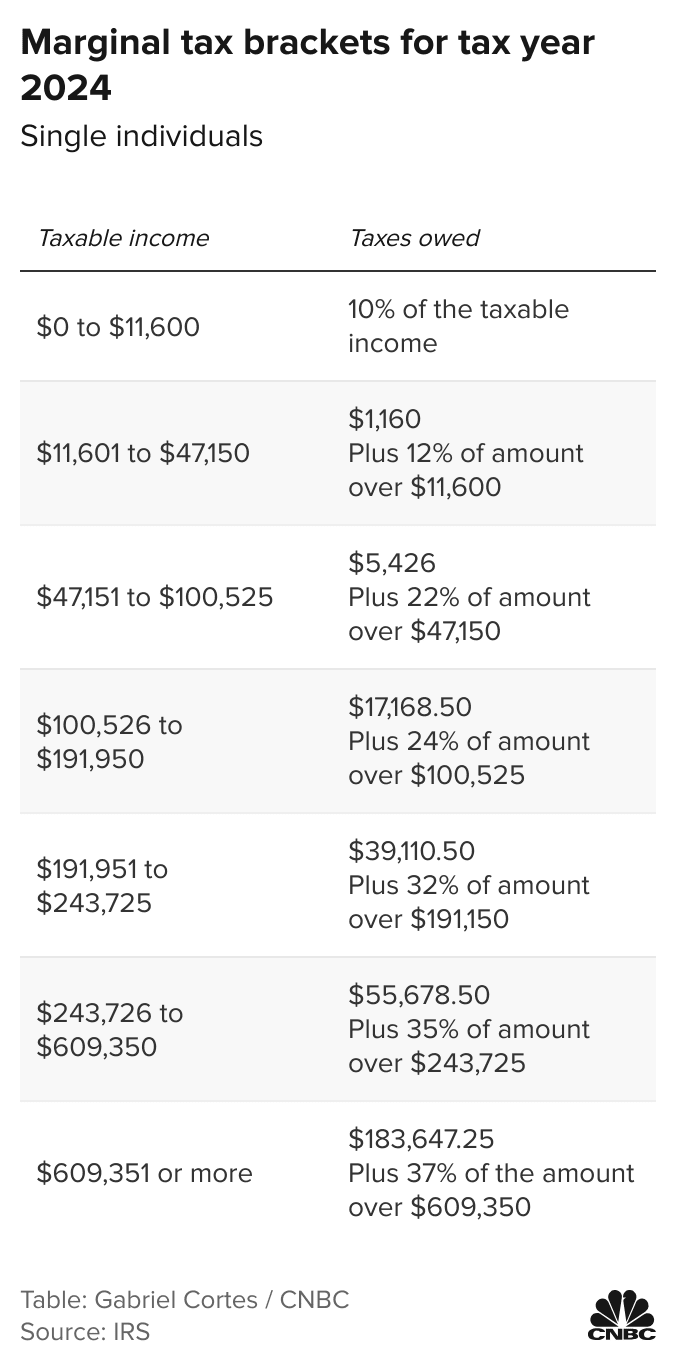

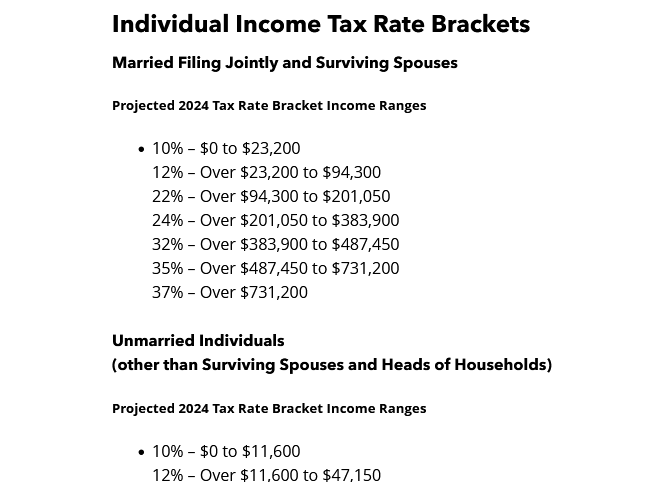

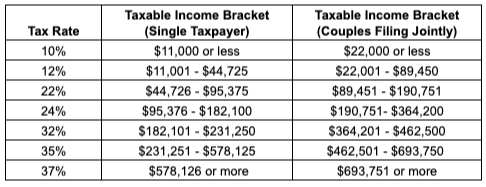

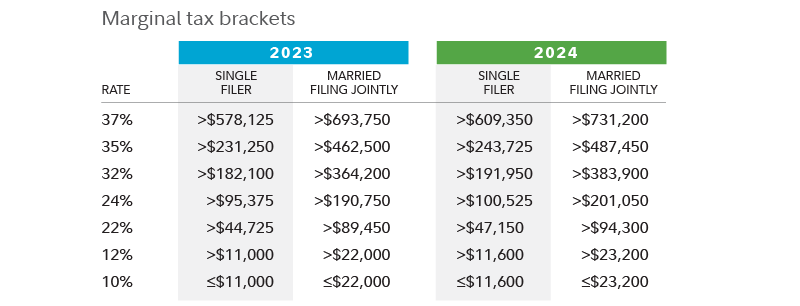

Federal Income Tax 2024 – This stemmed largely from funding increases under the Inflation Reduction Act, which was signed into law in 2022 by President Joe Biden. The changes included everything from eliminating paper backlogs . For both 2023 and 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2024 and what you need to know. .

Federal Income Tax 2024

Source : www.forbes.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com2024 Income Tax Brackets And The New Ideal Income Financial Samurai

Source : www.financialsamurai.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

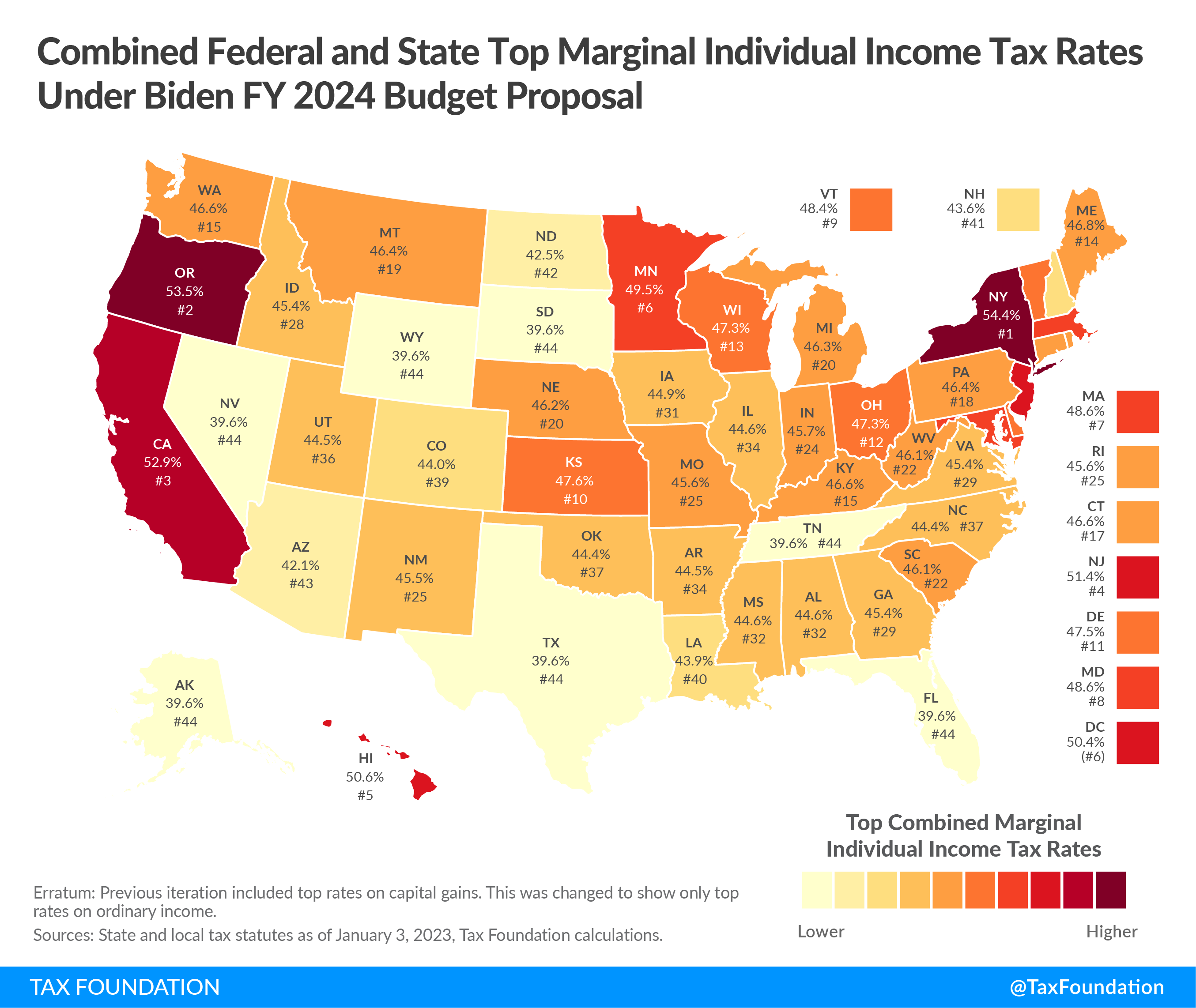

Source : www.forbes.comBiden Budget Taxes Top $4.5 Trillion | Tax Foundation

Source : taxfoundation.orgKick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.comTax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.comFederal Income Tax Brackets For 2024

Source : thecollegeinvestor.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comFederal Income Tax 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Tax brackets dictate how much you’ll pay on each part of your taxable income for the year. They’re not set in stone: Each year, the IRS adjusts the thresholds for its brackets based on an inflation . Come Monday, the IRS will start accepting and processing 2023 federal income tax returns. Filing your taxes is a task you may not like, but it’s one you can’t ignore – at least not without a .

]]>